HONPINE Harmonic Gear Reducer Manufacturer VS Laifual VS Leaderdrive

This article explores how HONPINE, as a harmonic gear reducer manufacturer, is building brand recognition in China. For many years, the Chinese harmonic reducer market was dominated by giants such as Leaderdrive and Laifual. However, as market competition intensifies and performance requirements for harmonic gear reducers continue to rise, competition among all major brands has become increasingly fierce.

Production Barriers of Harmonic Gear Reducers

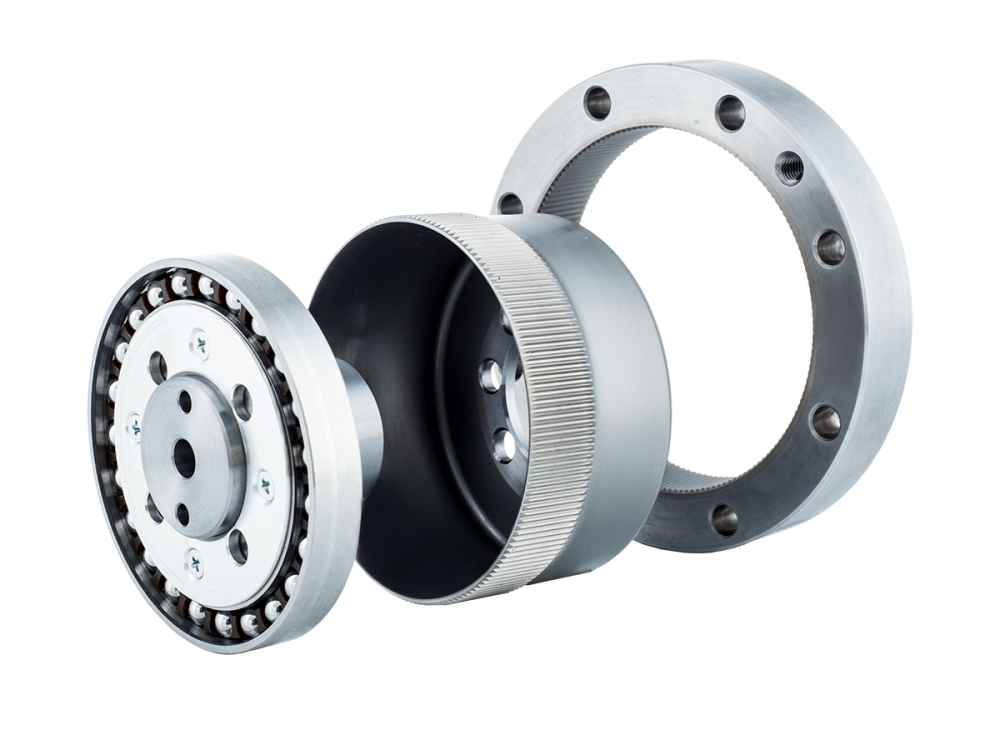

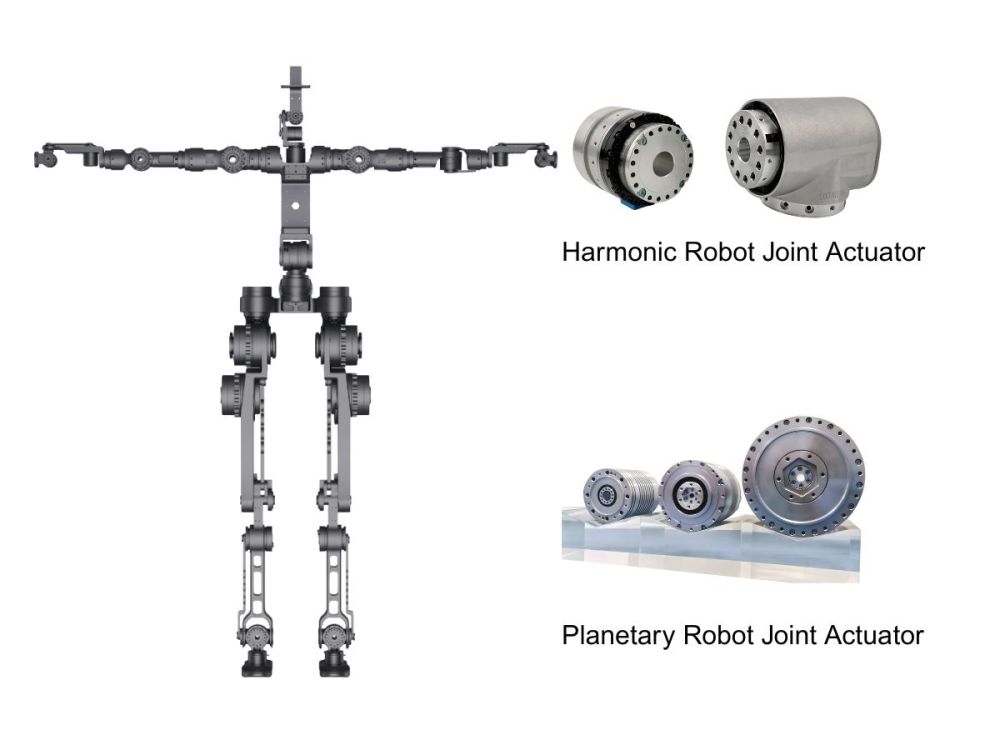

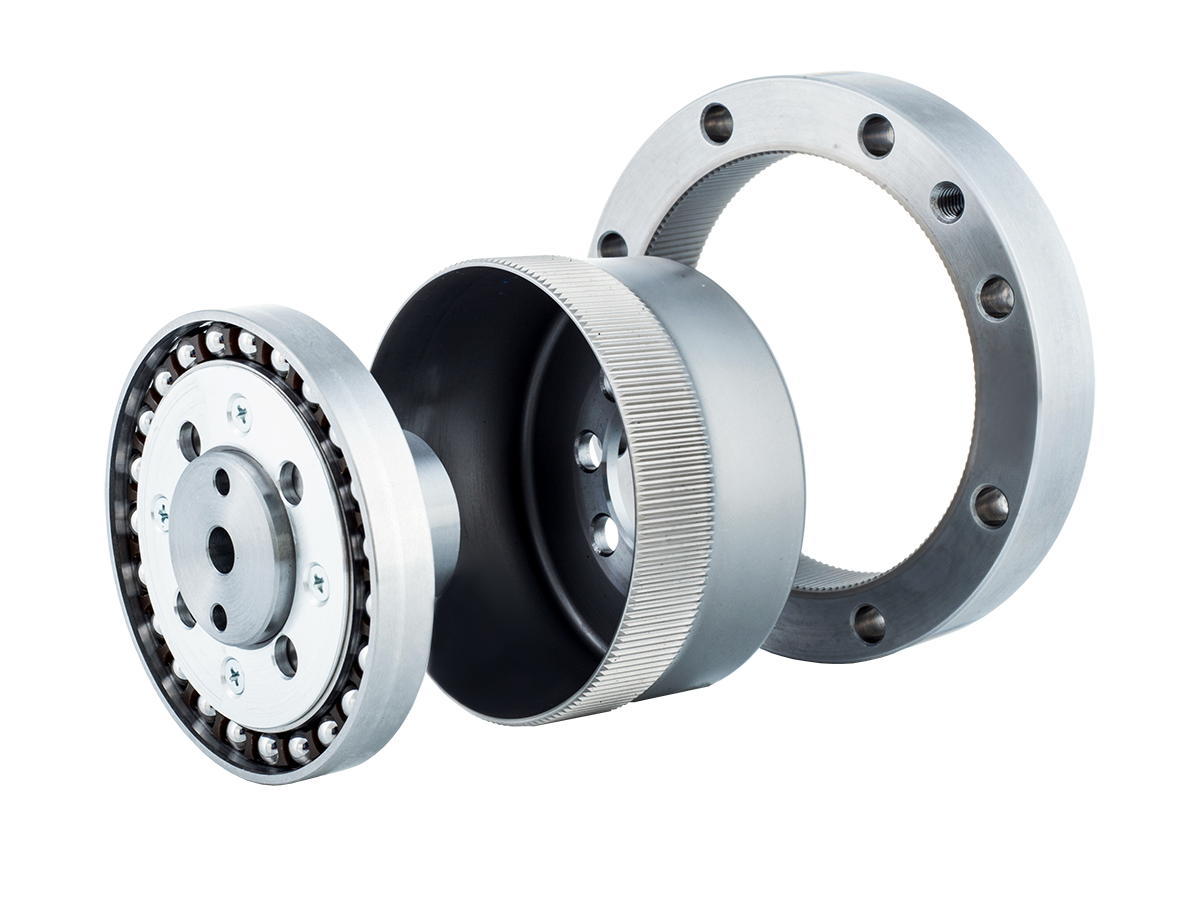

As a core execution component in robots, the harmonic gear reducer uses a wave generator to drive the flexspline to deform and achieve high-precision differential gear transmission. It plays a critical “joint-like” role in mechanical systems.

Its key technical advantages include:

Ultra-low backlash

High transmission accuracy

Long service life

Excellent stability

These factors make harmonic reducers an indispensable component in high-end manufacturing.

Their production is often described as a “micron-level system engineering task,” involving interdisciplinary expertise across materials science, mechanical principles, precision machining, and assembly technologies. Only a small number of companies are capable of producing harmonic gear reducers that meet industrial standards.

Industry Chain of Harmonic Gear Reducers

The upstream sector mainly consists of raw materials such as steel and aluminum alloys, as well as key components like bearings and gears.

Downstream applications cover:

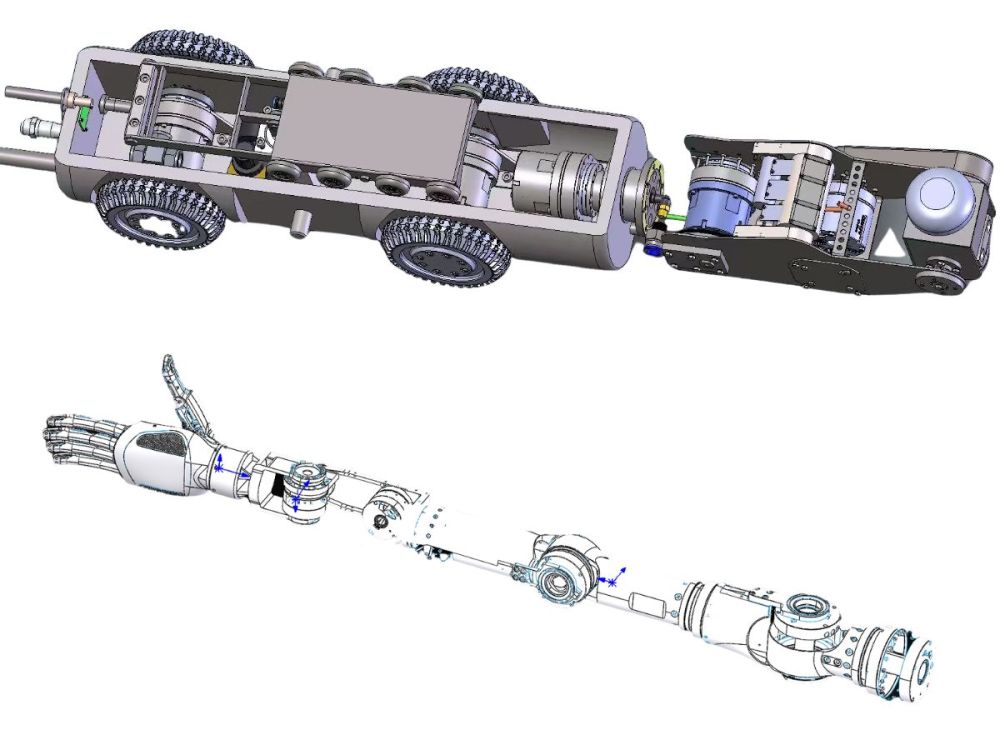

Industrial robots

Collaborative robots

CNC machinery

Aerospace

Medical equipment

Other attitude and joint control systems

Currently, robotics is the largest application field. Harmonic reducers rank first among the three core components of robots, accounting for up to 35% of a robot’s total component value—higher than servo systems and control systems.

With the upgrade of industrial automation and the rapid industrialization of humanoid robots, harmonic reducers have shifted from a supporting role in traditional machinery to a performance-defining core element in robotics.

Market Landscape & Key Players

By 2025, the global harmonic reducer market is expected to exceed USD 12 billion, growing about 25% from 2024. China represents the world’s largest single market, accounting for over 30% of global demand and increasing more than fivefold over seven years—primarily driven by the robotics industry.

Historically, the market relied heavily on imports. Japan’s Harmonic Drive is the global leader, controlling around 60% of the market and long dominating high-end sectors such as aerospace and medical devices. Nidec (Japan) and ILJIN (Korea) also hold notable shares.

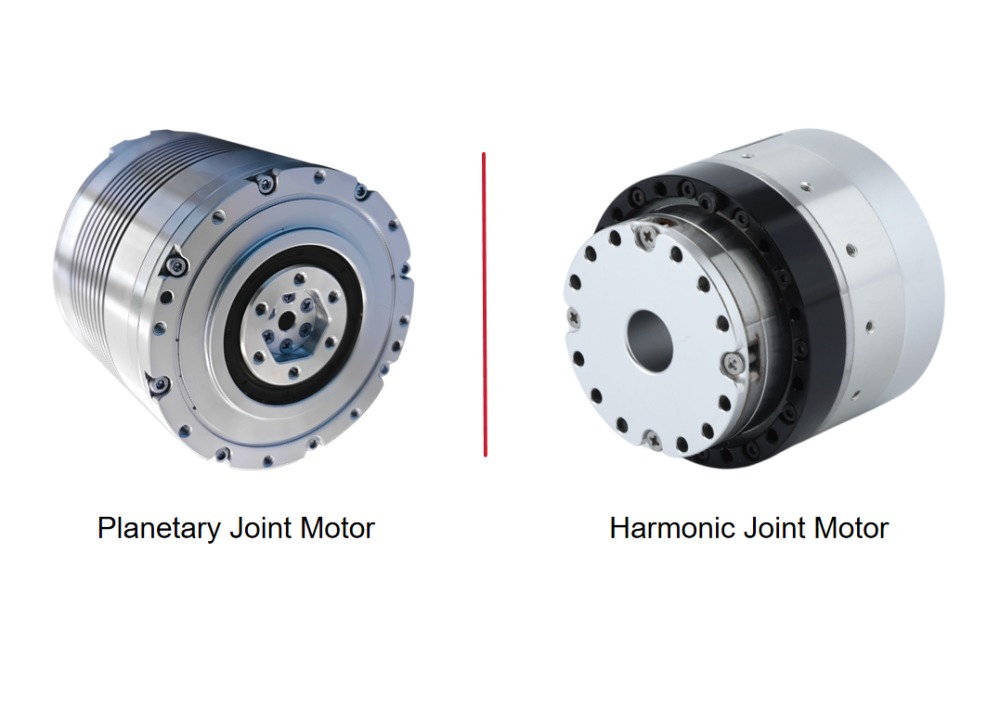

China’s Leaderdrive was the first domestic manufacturer to achieve mass production and is now ranked second globally. Newer players such as Laifual and HONPINE have exceeded certain performance indicators and currently compete strongly in cost efficiency, production capacity, and key technological innovations—particularly weight reduction to meet humanoid robot requirements.

How HONPINE Stands Out in an Increasingly Competitive Market

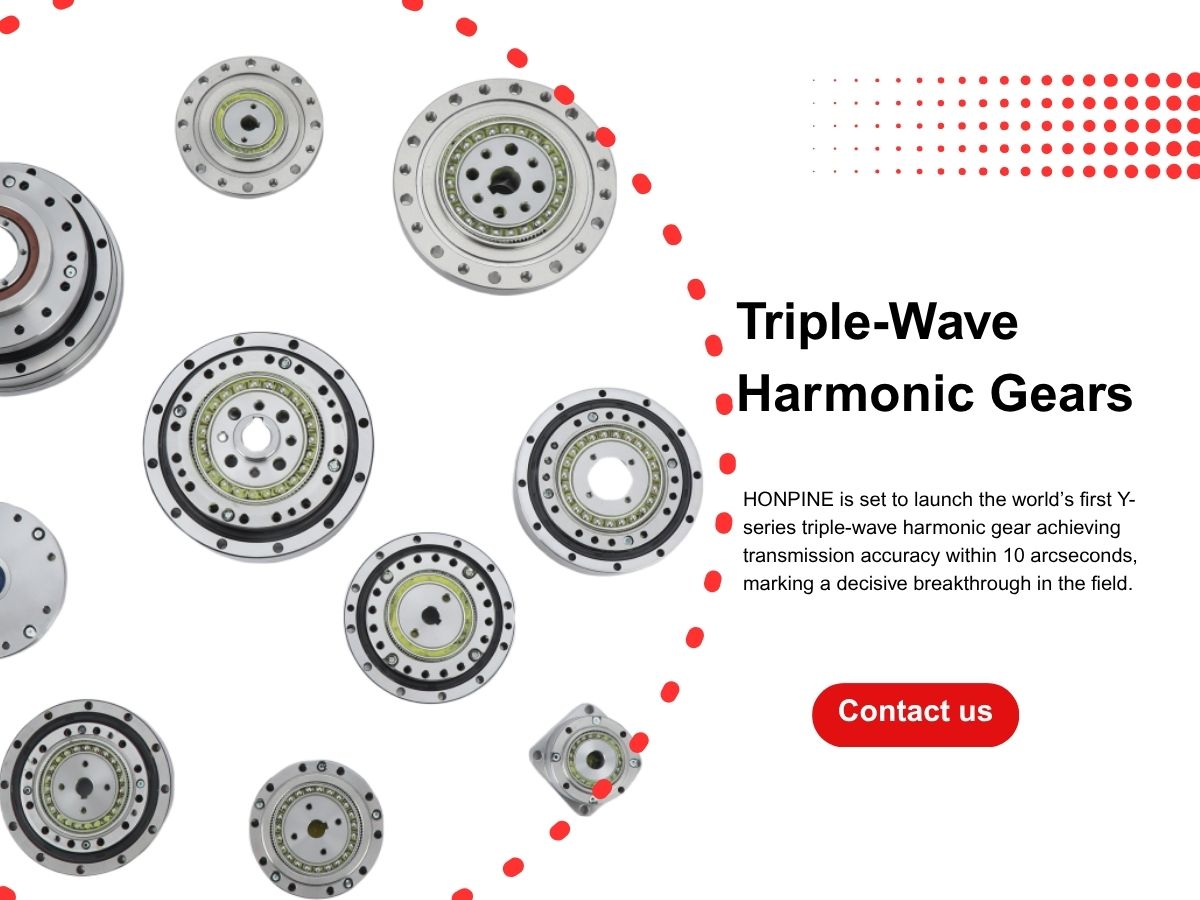

To meet growing industrialization needs, HONPINE has continuously achieved breakthroughs. As introduced in previous articles, HONPINE developed:

The latest ultrafine-grain technology

HONPINE also adapts rapidly to market demands by innovating new tooth profiles and launching:

Dual-circular-spline (dual steel wheel) harmonic reducers

Today, HONPINE offers one of the most complete size ranges, fastest technological iteration cycles, and most rigorous quality-inspection processes among harmonic gear reducer manufacturers.

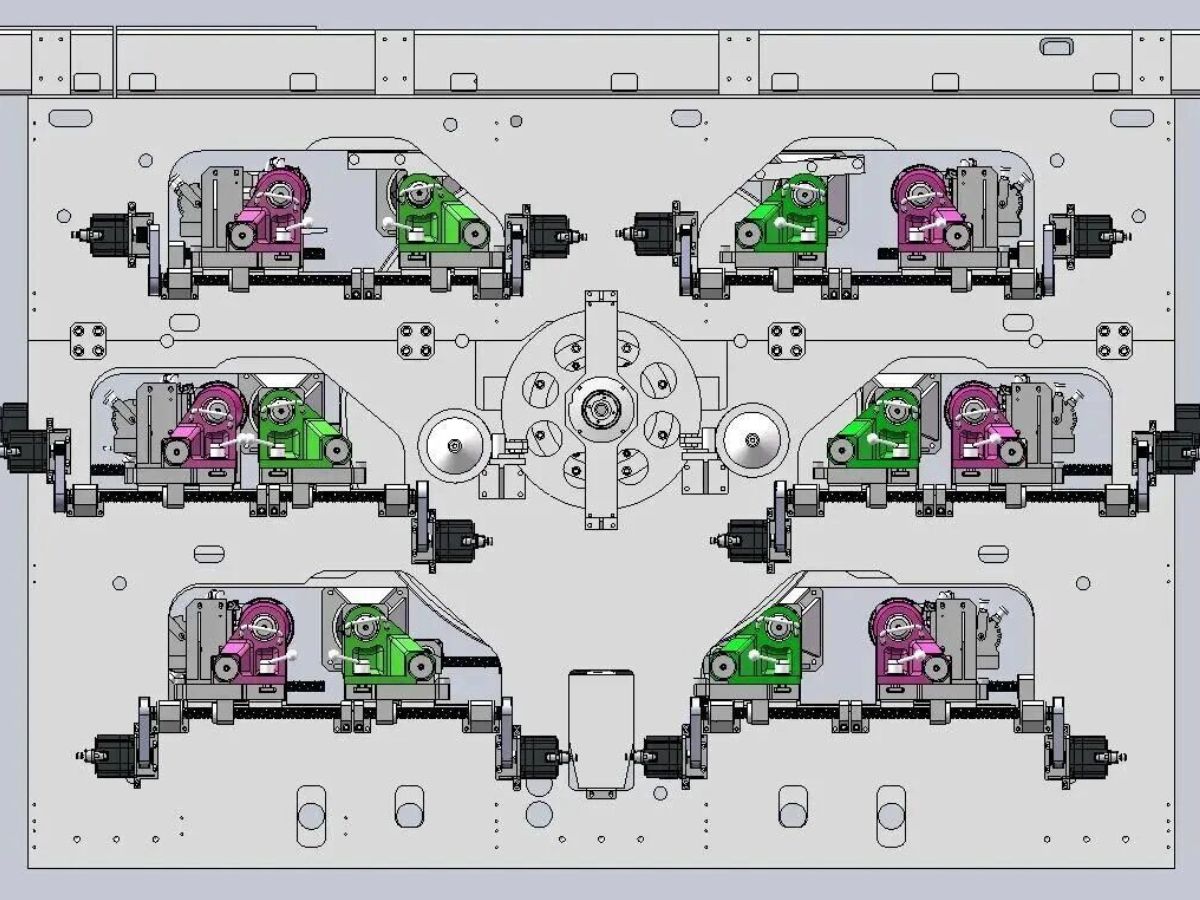

How HONPINE Strengthens Its Supply Chain

HONPINE fully leverages China’s mature industrial ecosystem, with:

R&D and design center in Shanghai

Manufacturing bases in Suzhou and Zhejiang

Regional collaboration efficiencies significantly enhance production speed, reduce costs, and strengthen overall operations.

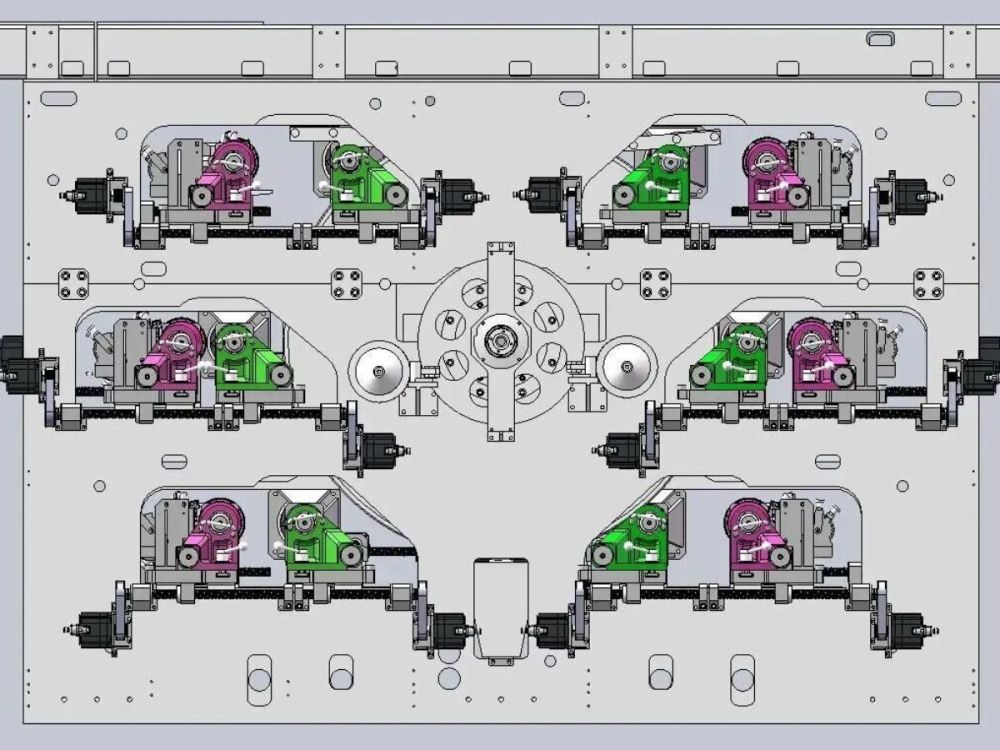

We have also introduced our newly expanded factory—built to match rapidly increasing market demand. HONPINE’s current production capacity reaches 2 million units per year, with expectations to reach 5 million units per year by 2026.

R&D Strength and Vertical Integration

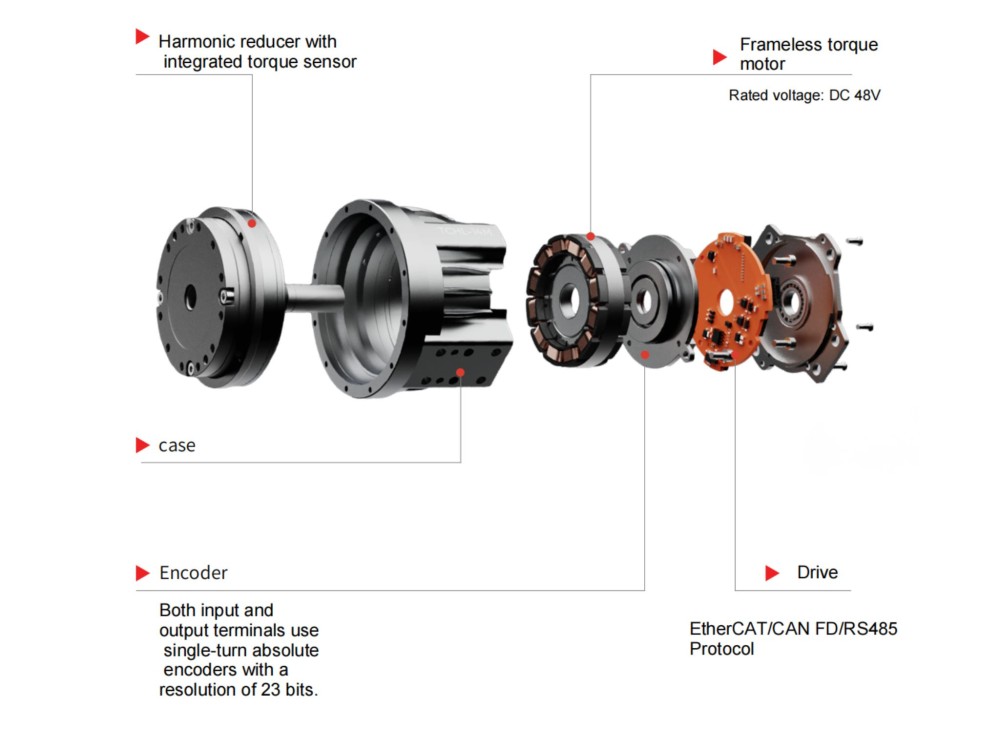

HONPINE now has over 100 R&D engineers. We continuously refine and develop harmonic reducer gear profiles while advancing integrated solutions such as:

Through vertical integration, HONPINE has increased the in-house production rate of flexspline bearings to 90%, reducing unit costs by 18% compared with outsourced parts.

This “develop one generation, mass-produce one generation” model enables HONPINE to maintain a strong competitive advantage over Laifual, Leaderdrive, and other rivals.

Read More

Learn more about the story of HONPINE and industry trends related to precision transmission.

Double Click

We provide harmonic drive reducer,planetary reducer,robot joint motor,robot rotary actuators,RV gear reducer,robot end effector,dexterous robot hand